Safe harbor 401k calculator

Dont Wait To Get Started. Deposit any missed elective deferrals together with lost earnings into the trust.

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

Salary Your annual gross salary.

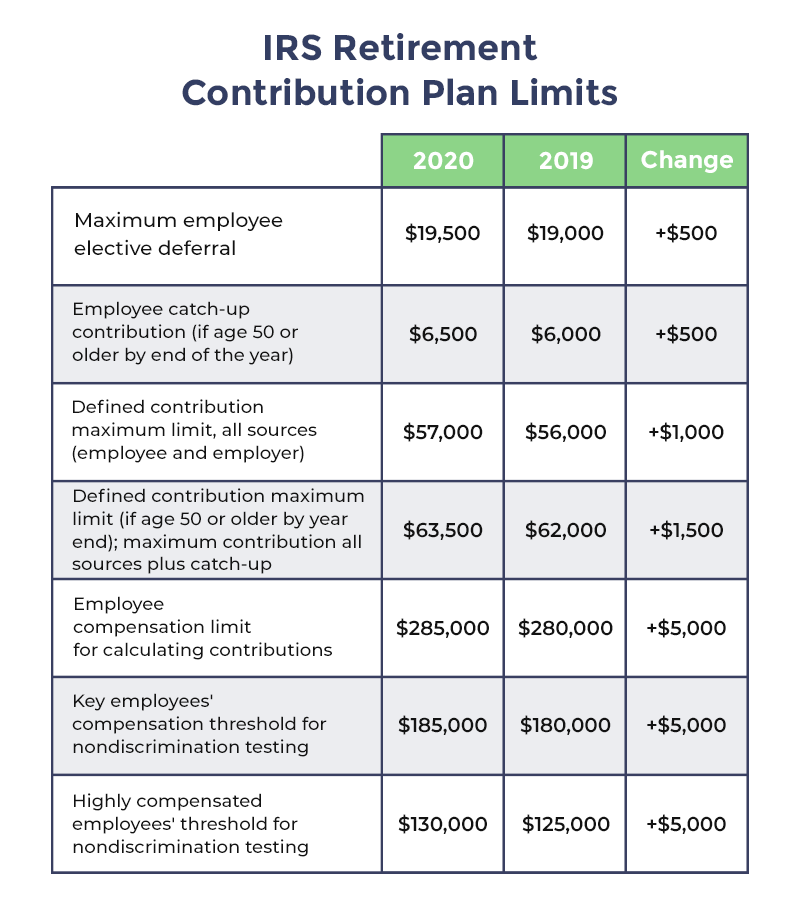

. If you wanted to have a safe harbor 401k for your business you basically have three options. Reasons to choose a safe harbor 401 k plan. In 2022 the basic employee deferral limits for a Safe Harbor plan are the same as any employer-sponsored 401 k.

A 401k plan is a widely used type of employer-sponsored retirement plan that allows employees to set aside pre-tax dollars for their retirementSafe harbor 401k plans are. This reduces the administrative burden faced by. Use our free calculator at Money Help Center to determine how much you need to save for retirement and how much you need to set aside each month.

The employer match helps you accelerate your retirement contributions. At present I am using the following. With a Safe Harbor 401k Employer Matching Is Mandatory.

Ad 10 Best Companies to Rollover Your 401K into a Gold IRA. The first two are matching options where your. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

The Safe Harbor provision allows employers to bypass the administrative headache uncertainty and expense of ADP ACP and. The calculator uses the safe harbor assumptions described in the ANPRM for estimating future contributions investment earnings and inflation. Check out the calculator to see where your numbers.

Using the calculator In the following boxes youll need to enter. How frequently you are paid by your employer. Determine which deposits were late and calculate the lost earnings necessary to correct.

Your expected annual pay increases if any. A safe harbor 401 k is structured so that all employees receive employer contributions to their retirement plan. The plan will be top heavy.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Our low-cost 401k plans are easy to setup online and are supported by our 401k advisors and specialists. To find out if a new Safe Harbor 401k plan is right for you or if you should consider converting your existing 401k plan to Safe Harbor simply call or email me today.

The tax credit opportunity is just one of the many reasons small businesses consider a Safe Harbor 401k plan. Additional Benefits of Safe Harbor 401k Plans. Types of Safe Harbor 401ks.

The new Safe Harbor Plan Resource Center will arm your team with plenty of information tools and insights to help you decide whether a Safe Harbor 401 k plan is right. Employees who are at least 50 years old have the ability to contribute an. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want.

How the Calculator Works. Protect Yourself From Inflation. This is often helpful for businesses looking to maximize owner 401 k contributions with the minimum expense.

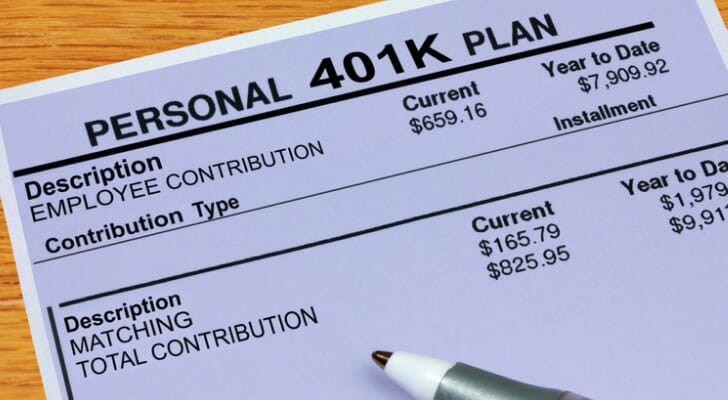

This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay weekly bi-weekly semi-monthly monthly your contribution and. 20500 per year for participants under age 50 and 27000. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your.

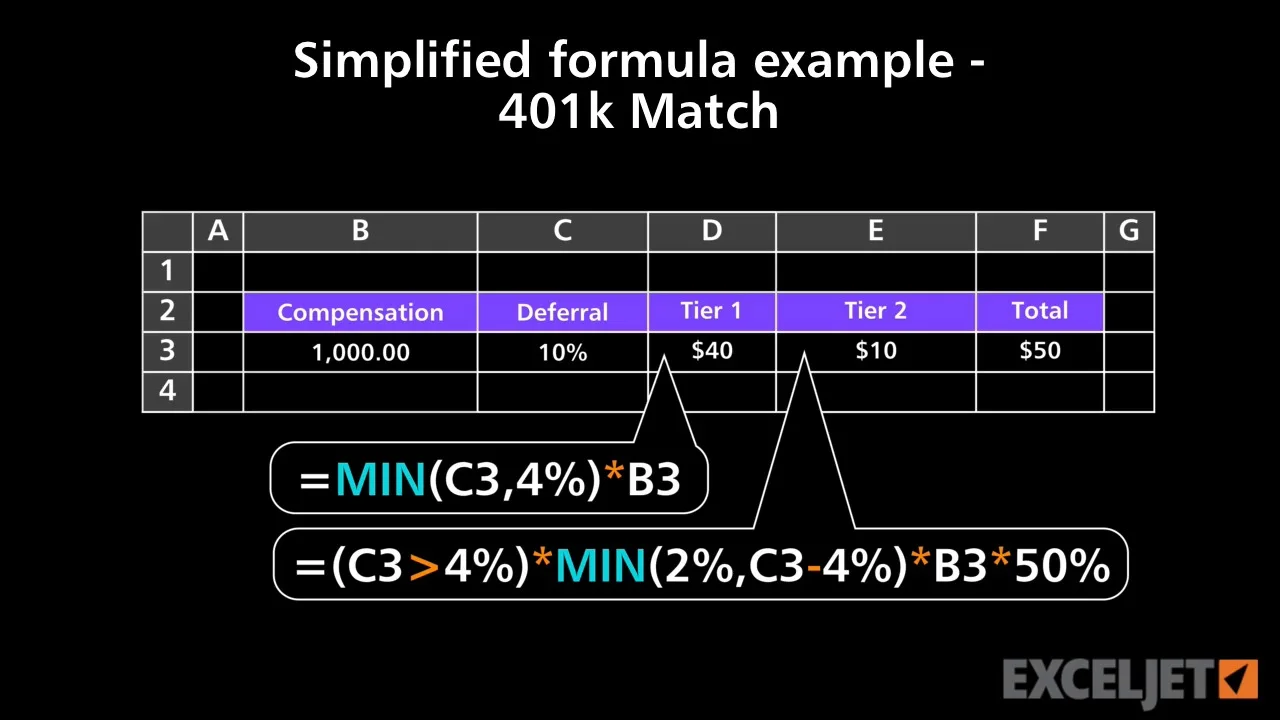

Knowing how much you need to. I am looking to create a simplified formula to plug into employer census data to work out the cost to implement Safe Harbor 401 k plans. Both safe harbor 401 k and traditional 401 k plans have a 2022 contribution limit of 20500.

TIAA Can Help You Create A Retirement Plan For Your Future. Because a top heavy 401 k plan must generally make a 3 minimum contribution to non-key. ShareBuilder 401k serves small business and medium-sized companies as well as.

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Safe Harbor Calculator Costs Of A Safe Harbor 401 K Human Interest

What Compensation Should We Use To Calculate Company Contributions To Our 401 K Plan

Safe Harbor 401 K Match Vs Nonelective Two Words For The Same Thing Or Two Different Options

What Is 401 K Safe Harbor Match Ubiquity

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

How Safe Harbor 401 K Plans Work Smartasset

Safe Harbor 401 K Plans For Businesses Fisher 401 K

Doing The Math On Your 401 K Match Sep 29 2000

How Safe Harbor 401 K Plans Work Smartasset

What Is A True Up Matching Contribution

Safe Harbor Calculator Costs Of A Safe Harbor 401 K Human Interest

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

Excel Tutorial Simplified Formula Example 401k Match

The Big List Of 401k Faqs For 2020 Workest

More Money Saving Travel Apps Travel App Saving Money Saving

Safe Harbor 401 K Edward Jones